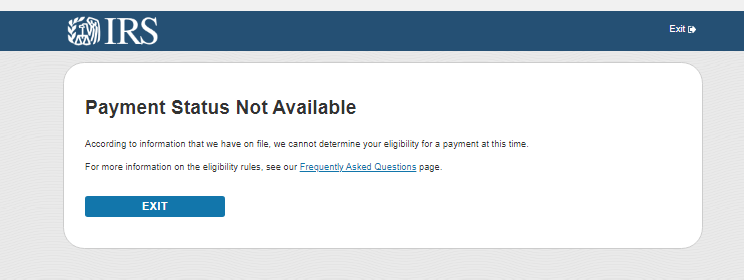

On Wednesday the IRS announced the Get My Payment site that would allow people to track their stimulus payment plus for those that hadn't previously provided direct deposit information they would be able to input that information. The IRS has said it's been a great success but our clients (and apparently a lot of other people based on comments on social media) have not be happy with the site. A large number of people have gotten "Payment Status Not Available" when they provide their information. Here is what we have found:

So please read my previous blogs about who is entitled to the stimulus money. Anyone who has filed a 2018 return and made less than $99,000 as a single person, $140,000 as head of household, or $198,000 as a married couple will be eligible for a portion of the stimulus money. If you owed money or had a check mailed the stimulus money will at least be mailed to the address on the 2018 tax return. If you filed the 2019 tax return the same rules apply. You will get your refund mailed to the address on that return.

Unfortunately there is no way to contact the IRS in regard to these payments because there are no phone lines open right now. I have done my best to communicate these issues to a contact I have at the IRS as well as through social media pages. At this time it's a waiting game. At the very least the stimulus amount will be added to the 2020 tax return if you qualify.

- The IRS has reported 80 million people got direct deposits on Wednesday. It appears that people who filed and had direct deposit in 2018 have for the most part received their stimulus money if they haven't filed the 2019. It does seem like the system is showing the information as to it being deposited with some information about the account it was deposited into. They are also supposed to be mailing checks to make people aware of the deposits. If the money wasn't received there is information on the letter as to how to handle it.

- People that have filed 2018 but had a balance due or owed money are not showing up in the system.

- People that have filed in 2019 in the last couple weeks are not showing up in the system (seems the returns are still being processed). This is true even for people that have already received the direct deposit refunds for filing their taxes. It seems these people haven't received their stimulus money yet.

- People that filed 2019 earlier in the year are showing up in the system. If they had direct deposit they have gotten their refund. If they had a check mailed or owed they are showing up in the system with the ability to put in direct deposit information for their stimulus money to be direct deposited. (We still have no idea how this will work if they will get their money direct deposited fairly quickly or what.)

- Anyone that hasn't filed a tax return isn't showing up in the system. However they will be issuing stimulus money to those who are on social security or railroad retirement. If you don't fall into those categories and are not required the file the IRS does have an option to provide information so they can send you the stimulus money. Even for people that have provided information since the system came up on Monday, they are not showing up in the system.

So please read my previous blogs about who is entitled to the stimulus money. Anyone who has filed a 2018 return and made less than $99,000 as a single person, $140,000 as head of household, or $198,000 as a married couple will be eligible for a portion of the stimulus money. If you owed money or had a check mailed the stimulus money will at least be mailed to the address on the 2018 tax return. If you filed the 2019 tax return the same rules apply. You will get your refund mailed to the address on that return.

Unfortunately there is no way to contact the IRS in regard to these payments because there are no phone lines open right now. I have done my best to communicate these issues to a contact I have at the IRS as well as through social media pages. At this time it's a waiting game. At the very least the stimulus amount will be added to the 2020 tax return if you qualify.

RSS Feed

RSS Feed